What is the estimation window?

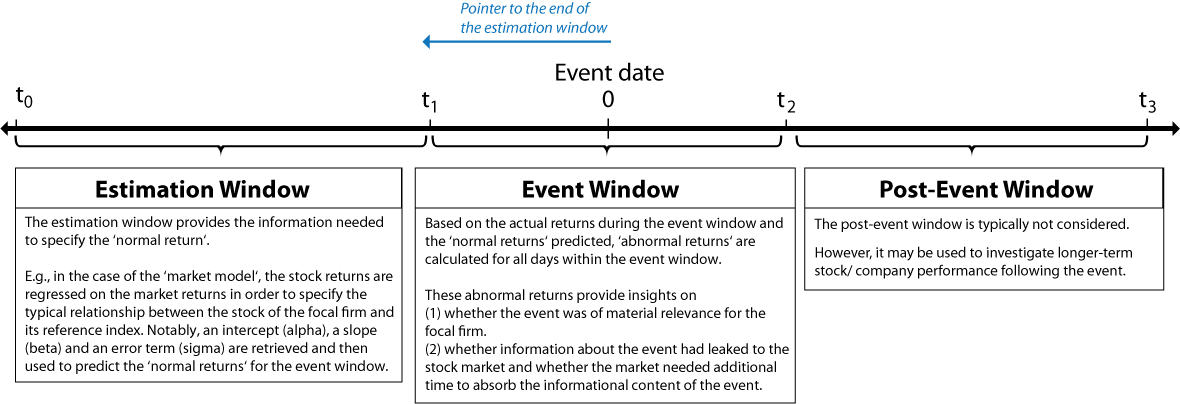

The estimation window lies earlier in time than the event window. It serves one purpose: to inform the expected return models about the typical relationship between the analyzed company and its reference index. It does so by performing a regression on the company stock's returns with the market (or other factors) returns as the independent variable(s).

What length should it have?

For the identified relationship to be robust, the estimation window needs to be of sufficient length. Most event studies use estimation windows of at least 80 trading days. Our recommendation is to use 120. For a more extensive discussion of this topic, visit our page on the methodological blueprint of event studies.

The estimation window should not overlap with the event window. For this reason, we recommend using a gap / pointer to the end of the estimation window that is greater than the distance between the event date and the beginning of the event window - see the below graphic and the example underneath.

For example, in case your event window is (-5,5), you should choose a pointer of at least -5. If informational leakage of the event is possible, pick a larger negative number, such as -10.

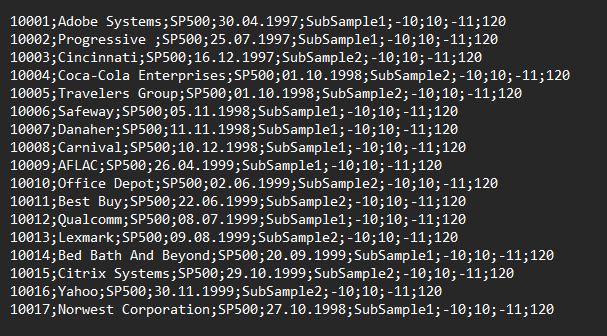

How does this show up in the request file?

As you design your empirical analysis, you will write a request file with all the parameters you want to apply. You see an example request file below. For each line (i.e., event that you study), you specify the company affected, its reference index, the event date, and so forth. The last two parameters you provide are about the estimation window. In the below example, the "pointer to the end of the estimation window" is set to -11 (i.e., 11 trading days prior to the event), and the length of the window is set to 120 trading days.

What does it mean for my firm and market data files?

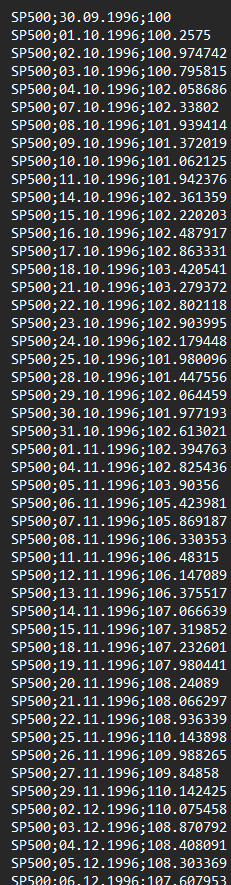

The estimation window and its positioning relative to the event data have the following implication for your firm and market data files: They jointly define the time series of data you need to provide prior to the event. Note that the data you need to provide after your event depends on the event window.

In case you choose the above parameters of -11 and 120 for the pointer and the estimation window length, you will need your financial data on the firm and the reference index to cover this period. Assuming your event window starts right thereafter, you would need 131 returns prior to the event, which equates into 132 closing prices (or trading dates). In terms of calendar days, this easily translates then into 160 or more days given weekends and other non-trading days, such as public holidays.

Please see below a screenshot of the input files from the sample data set. The point you should notice is that the market data file must cover the joint time ranges of your firms from the firm data file.

| Firm Data File | Market Data File |

|

|